Click on image to enlarge.

The University of Chicago is the birthplace of tax cuts for the wealthy, an economy theory that results in boom and bust cycles, and the stuff that makes Banana Republics possible. To illustrate my point, this graph shows the relationship between marginal income tax rates and the income gap between rich and poor for the past 90 years (source):

Click on image to enlarge.

As the graph illustrates, the greater the gap between rich and poor, the more unstable economies will become. In 1928, the year before Black Monday triggered the Great Depression, the top 0.01 percent (the elite) averaged 892 times more income than the bottom 90 percent. From the post-war period until the Reagan era, higher marginal income tax rates for the rich meant more money in the pockets of the middle class … resulting in real economic growth. By 2006, however, middle class wages had shrunk, inflationary rises in cost of living had consumed all marginal income, and middle class savings rates turned negative. The top 0.01 percent averaged 976 times more income than the bottom 90 percent, thus reenacting the same conditions that triggered the Great Depression. Here is another view of the same data (source):

Click on image to enlarge.

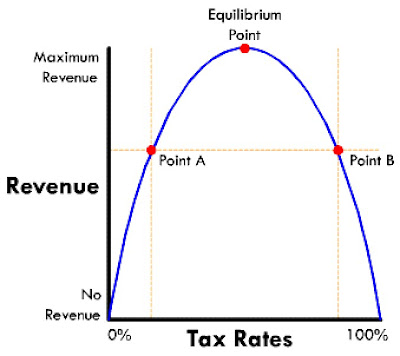

Arthur Laffer is a "supply-side" economist who served on Reagan's Economic Policy Advisory Board from 1981 to 1989. Laffer is best known for the Laffer Curve, an illustration of tax elasticity, which claims that a decrease in tax rates will result in an increase in tax revenues. What began as a thought experiment on a paper napkin over lunch has turned into a mantra and marching orders for Banana Republicans ever since.

Click on image to enlarge.

According to theory, tax revenues would be zero if tax rates were either 0% or 100%. If the tax rate is zero, there is no tax revenue because there are no taxes. If the tax rate is 100%, there are no taxes because citizens would not want to work. Assuming everything is taken from them, citizens would resort to barter or an off-the-books economy. As taxes increase from zero percent, revenues will rise but once taxes get too high, revenues will fall because there is a disincentive to work.

One problem with Laffer’s thought experiment is that the equilibrium point (the lowest possible tax that yields the highest possible revenue) can never be clearly established. There are always concerns about the costs of wars, federal budget deficits, and the servicing of public debt. Since the equilibrium point varies with public opinion, what matters more is the range of marginal taxation, not a fixed point to be taken literally.

In fact, historical data contradicts Laffer’s thought experiment. In the 8 years following Reagan’s tax cuts, personal income tax revenues rose from $353 million in 1982 to $516 million by 1989, an increase of 46%. During the same time interval, the federal deficit more than doubled.

In contrast, Clinton’s tax increases resulted in a personal income tax revenue increase from $586 million in 1993 to $1.137 billion by 2000, an increase of 94%. The Reagan era produced gigantic budget deficits. In contrast, the Clinton years yielded a federal budget surplus during a period of unprecedented economic growth (source).

Bottom line: The middle class is the economic engine that drives the economy. Marginal income tax policies that favor the wealthy and punish the middle class set the stage for disastrous consequences, as we have recently experienced. Thus, the Republican mantra of lower taxes, lower taxes, lower taxes, do not always achieve a desired economic outcome. As we enter into yet another public debate on tax policy and federal deficits, it is useful to keep past economic policy failures in mind.

For another perspective, please refer to my post of February 10, 2009: A Ghost of Depression Past.

H/T to Brad Delong for posting the Tilburg Ranking.

This comment has been removed by a blog administrator.

ReplyDeleteWe're living in a postrational, faith based age, amongst people for whom history is irrelevant. Making the situation crystal clear, as I think you've done, is like clearly explaining tensor calculus to Sarah Palin.

ReplyDeleteThey're at us like mad dogs, from every angle, grabbing at every appendage, snarling and drooling; and they will inevitably bring us down.

There's no way to save it and no way to placate or dismiss the angry mob save to let the horror run its course and to let some other people in some other country try to raise another civilization without us.

Very interesting, Octo.

ReplyDeleteDepressing, too, especially when you consider the 100 mil bonus this year for the CEO of Goldman Sachs, the income inequality that's highest ever, and the rising poverty and hunger in the ranks of (what used to be) middle class.

Elizabeth, the graph in your "highest ever" link looks a lot like the two graphs above. Same data sets, I would surmise. Confirmation is gratifying, but the implications are disturbing.

ReplyDeletePerhaps what bothers me most of all are the reactionary elements who scream, "socialism, socialism" whenever we talk about this. This is not about "socialism" but about economic fairness and justice.

Perhaps I should have raised a few more points such as increased worker productivity during a period of wage decline. IOW, people worker harder and produced more but got less than zero for their effort. All economic growth went into the pockets of the wealthy while wage earners got nothing.

Another point, Laffer makes the argument that lower taxes increases incentive. Bullcrap. The only thing Laffer ever proved is that lower taxes increases greed, while the middle class gets stuck with bailouts and public debt.

Perhaps, in a few weeks, I should re-post this material under a different title and include these points. What do you think?

Damn, this makes my cephalopod blood boil!

Damn, this makes my cephalopod blood boil!

ReplyDeleteYours and mine, too. It won't hurt to repost it and continue hammering at it.

And yes, we do have the working stiffs and the members of the disappearing middle freak out at the mere mention of SOCIALISM! (OMG!), woefully oblivious to what it really means and how it would benefit them. Mind-boggling.

I had a brief blogpost on it a couple of days ago (my shamelessness continues;), Why Turkeys Vote for Christmas, and wanted to post it in The Swash Zone as well, but the timing was not right. Still, go see it if you want.

Octo, this may bring some ideas for a relief of your boiling cephalopod blood.

ReplyDeleteGrass roots movements that cross party lines and explain the data contained in your graphs in a sound bite are needed.

ReplyDeleteHow do we start a grass roots movement? How do we help the majority of America recognize the new King George? How do we keep them from being duped by a wealthy few who control almost everything?

maleeper, I hope my next comment doesn't come across as presumptuous, but I think a group blog such as this can function as a mini-grassroots think tank.

ReplyDeleteCase in point, conservative think-tanks outnumber their liberal counterparts by more than 4:1. Our side is doing a very bad job in crafting messages that resonate with the public.

Questions I have pondering for a long time: Why do progressives have a hard time framing their message? Why are tea baggers demonstrating against their own self-interest and arguing the case on behalf of plutocrats? Why are they not allied with us? How do Republicans turn their own policy failures into election victories?

We have good minds here. We can study this, talk about it, and make a contribution.

Its a damn shame. Here are some of us ... semi-retired or retired ... having spent our lives fighting the good fight ... yet finding ourselves losing the contest for progress? That is why I spend more time reading, studying, thinking, and blogging. I still hope one can make a difference.

"Why do progressives have a hard time framing their message? "

ReplyDeleteDo we, or is the peter principle at work? You can work a dog into a frenzy until he attacks his best friend, but you won't get far appealing to his powers of reason.

They're just too damned stupid for modern life.